Accounting Software

Finance and Accounting for Modern Companies

Close quickly with confidence and report financials faster and accurately

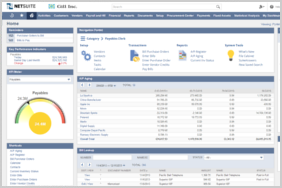

NetSuite cloud financials and accounting software helps finance leaders design, transform and streamline their processes and operations. NetSuite seamlessly couples core finance and accounting functions with strong compliance management, which improves business performance and increases financial close efficiency while reducing back-office costs. With real-time access to live financial data, you can quickly drill into details to quickly resolve delays and generate statements and disclosures that comply multiple regulatory financial compliance requirements such as ASC 606, GAAP, SOX and others.

Features

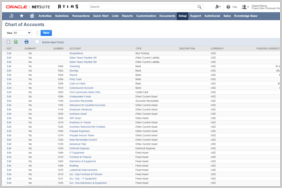

General Ledger

Transform your General Ledger into a dynamic business asset

NetSuite transforms the General Ledger from a static, one-size-fits-all into a dynamic asset that enables companies to tailor the General Ledger to meet their unique business needs and changing conditions. NetSuite’s General Ledger gives finance professionals flexibility and visibility, richer reporting functionality, enhanced audit trails and new support for multinational financial management.

Key Capabilities

- NetSuite’s dynamic General Ledger eliminates the need for manual journal entries by letting users add custom GL impact lines to transactions such as invoices or vendor bills across single or multiple accounting books, reducing the time and effort required for account reconciliation, period close and audit processes.

- Finance teams can define unlimited custom General Ledger segments such as profit center, fund, program, product line and more, in addition to the standard subsidiary, class, department and location segments. This improves accuracy and saves time by ensuring that General Ledger financial impact follows double-entry accounting principles and balances across all segment combinations.

- NetSuite’s Multi-Book accounting capabilities eliminate data entry replication and reduce the need for error-prone manual adjustments to your accounting and reporting processes that are created when managing unique sets of books per accounting standard. With pre-built mapping capabilities between your primary and secondary chart of accounts, as well as book specific functional currencies, the NetSuite Multi-Book engine can record all book-specific activity based on a single business transaction from the General Ledger, revenue recognition, expense amortization, depreciation, P&L allocations and more.

Accounts Receivable

Optimize receivables and accelerate cash flows with total control

Gain added liquidity to fund growth, shorten the credit-to-cash cycle, enhance service levels and seize new investment opportunities as they arise with NetSuite’s Accounts Receivable solution. Bring your collections processes into the 21st century with an end-to-end AR experience for automating and streamlining every aspect of invoice delivery, credit terms and collections management.

Key Capabilities

- Streamline operations and instill corporate and fiscal discipline by automating the retrieval and presentation of billing information from diverse sources.

- Generate recurring invoices for easy subscription management and send invoices by email and offer even more payment options.

- Automatically post order transactions to general and AR ledgers with accurate tax calculations on each invoice for automated tax processing and billing.

- Provide customers with self-service access to real-time information relating to purchase orders, inventory and payment information.

- Get the insights you need—configurable dashboards, reports and KPI’s provide a real-time view into customer aging, invoice analyses, recurring invoices, deferred revenue, exception reports to flag account anomalies.

- Access the SuiteApps marketplace where hundreds of innovative third-party solutions that help integrate and extend NetSuite with industry-specific solutions.

Accounts Payable

Automate AP, save time, improve control and increase productivity

Improve liquidity, mitigate funding gaps, realize higher profits and ensure compliance by leveraging NetSuite’s Accounts Payable solution that automates the processing and payment of invoices.

Key Capabilities

- Automate the calculation of discounts and eliminate manual data entry and associated errors and minimize the time and effort it takes to process bills from vendors.

- Simplify and automate exception processing when invoices do not match purchase orders or receipts.

- Improve payment controls, no bill is lost, forgotten or paid twice and no fraudulent invoices are paid with real-time visibility throughout the A/P process.

- Retrieve bills, item receipts, vendor contracts that are attached to each vendor and/or individual AP transaction and improve reconciliation, streamline accrual processes and produce more-accurate financial statements.

- Access the SuiteApps marketplace where hundreds of innovative third-party solutions that help integrate and extend NetSuite with industry-specific solutions.

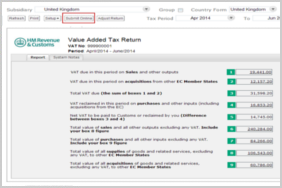

Tax Management

Automated domestic and global tax compliance

NetSuite’s configurable tax engine provides end-to-end domestic and global tax management through one simple, easy-to-use system that generates detailed reports analyzing transactions down to line item tax details in real-time. The NetSuite tax management solution streamlines the global tax compliance process, saving time, reducing costs and errors. NetSuite supports every known global currency and exchange rate and allows accounting departments to process taxes in accordance with country-specific laws.

Key Capabilities

- Supports tax calculations at multiple global levels and locations for over 50 countries and multiple currencies.

- Flexible tax engine automates calculation of Canadian HST, Mexican IVA, German Mwst, Philippines VAT, Australian GST and more.

- Cross border sales and Intrastate reporting across all EU countries, including online capabilities.

- Handle local taxes across subsidiaries that allows for multiple tax schedules for everything from GST to VAT, to consumption tax or general sales tax.

- The right rate is automatically applied to every transaction every time.

- Offers SuiteTax API enabling select third party tax solutions to easily integrate with NetSuite.

- Access the SuiteApps marketplace where hundreds of innovative third-party solutions that help integrate and extend NetSuite with industry-specific solutions.

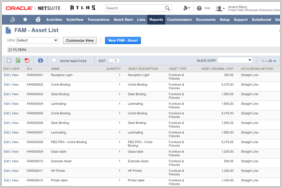

Fixed Assets Management

End-to-end lifecycle management for plant, property and equipment

NetSuite Fixed Asset Management enables you to maintain and control the complete lifecycle across depreciating or non-depreciating assets from creation to depreciation, revaluation and disposal including support for international markets. NetSuite Fixed Asset Management supports detailed asset management, including maintenance schedules and insurance, while providing tight accounting integration so that your fixed asset information is always accurate.

Key Capabilities

- Manage the complete asset lifecycle and easily report on all fixed assets and easily track depreciating or non-depreciating company assets.

- Completely integrate asset management with accounting and eliminate manual effort and multiple spreadsheets.

- Leverage support for all standard depreciation methods and create and customize unlimited depreciation methods as needed.

- Depreciation and asset retirements are directly posted to NetSuite accounts which allows you to comprehensively report across assets, valuation and depreciation.

Cash Management

Monitor, predict and manage cash across global locations and entities in real-time

NetSuite’s Cash Management solution enables treasury groups to be more strategic than ever before and focus on scaling the treasury organization by providing a complete view of the company’s money flows and cash position. NetSuite’s Cash Management provides your finance team the visibility and reporting they need to optimize cash, control bank accounts, manage liquidity and deliver compliance.

Key Capabilities

- Access a complete solution for addressing critical planning, processing and reporting requirements of global treasury units.

- Gain real-time insight into global transactions across bank accounts and credit cards.

- Manage cash across global locations and entities in real-time.

- Monitor and forecast cash requirements, perform automated bank reconciliations, distribute payments efficiently and securely and automatically generate accounting entries.

- Access the SuiteApps marketplace where hundreds of innovative third-party solutions that help integrate and extend NetSuite with industry-specific solutions.

Payment Management

Complete payment management solution that centralizes, streamlines and simplifies your payment needs

NetSuite’s SuitePayments is the smart way to meet all of your payment processing needs directly from within NetSuite. Whether your business accepts payments through online self-checkout or for the settlement of an outstanding invoice, you can accommodate all customer preferences. And, because it seamlessly integrates with NetSuite, you will have access to payment-related information in real time. SuitePayments is a complete payment management solution that supports most payment options and helps prevent fraud.

Key Capabilities

- Accept a variety of credit and debit card types and other electronic forms of payment for online payment processing needs.

- Support card payments for recurring and installment billing, as well as split and partial payment transactions.

- Out-of-the-box capabilities to enforce controls around card-related verification, authentication, encryption and more.

- Gain visibility and improve payment control by accessing and managing all the payment types you offer in one place.

- Serve different geographical markets with multi-currency and multi-site capabilities.

- Offers SuitePayments API for payment gateway integration.