Pay

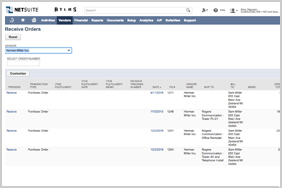

Easily match purchase orders, item receipts and vendor bills with configurable workflows to optimize cash flow.

Automating the receipt of ordered items, processing vendor bills and planning payments in a timely manner are key in vendor relationship management. NetSuite’s graphical workflow tool (SuiteFlow) can be configured to establish the criteria you want to use to manage this process. Encouraged collaboration between the requestor, purchaser, vendor, receiver and accounts payable promotes optimal vendor relations.

Features

Item Receipt

Clearly communicating ordered items, expected delivery dates, quality requirements and specifications is critical in maintaining operational efficiency. With NetSuite, sharing information with all parties is simple. Using the vendor portal, suppliers can log in at any time and get the latest relevant information. Confirmation- and update-related communications are automated and the actual receiving process can be performed with barcode scanners using NetSuite’s Warehouse Management Solution.

Key Capabilities:

- Simple but effective receiving processes

- Quickly verify item specifications

- Automate receiving with barcode scanners

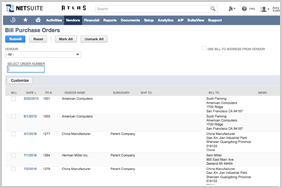

Vendor Bills

Receiving and entering invoices from suppliers is the first step in the process of completing the procure to pay cycle. When a vendor is submitting an invoice against a purchase order, NetSuite lets users select the order it was based upon and pre-populates all of the relevant information for verification. Vendor bills can also be manually entered, imported from a CSV file or automatically imported through web services in cases where tighter integration is desired.

Key Capabilities:

- Pre-populate based on purchase order

- Automatic verification

- Options for importing, updating automatically.

3-Way Match and Pay

Once the purchase order, receipt and bill have been entered into the system, the formal process of comparing and matching these documents begins. NetSuite has standard fields to determine the typical matching criteria that should be used along with several SuiteFlow-based workflows that allow you to handle exceptions while automatically approving those that comply based on pre-defined specifications. Once approved, the accounts payable department can determine which bills to pay and in which timeframe to optimize cashflow.

Key Capabilities:

- Ensure compliance with matching criteria

- Workflow driven approvals

- Schedule payments for optimal cash flow