Planning and Budgeting

Integrated Planning, Budgeting and Forecasting

Oracle NetSuite Planning and Budgeting enables quick adoption of world-class financial planning and budgeting across lines of businesses with flexible and customizable deployment options. Oracle NetSuite Planning and Budgeting facilitates both company-wide and departmental financial planning with modeling capabilities, approval workflows and reporting within one collaborative scalable solution. Oracle NetSuite Planning and Budgeting uses a powerful calculation engine which can accommodate a wide range of business logic with fast in-memory aggregation and instant financial planning analysis and reporting.

Oracle NetSuite Planning and Budgeting offers comprehensive integration with Microsoft Office tools such as Microsoft Outlook, Excel, Word and PowerPoint with Smart View for Office. Users can leverage Excel as the environment for adding custom members on the fly, slicing and dicing data and ad-hoc modelling. Common financial planning actions, such as spreading and allocation, are available within planning data grids rendered within Microsoft Excel.

Planning and Budgeting

organizations of all sizes to quickly adopt a world-class planning and

budgeting application offering market-leading functionality across lines

of businesses.

Budgeting combines task lists, instructions, dashboards and graphical reports.

Features

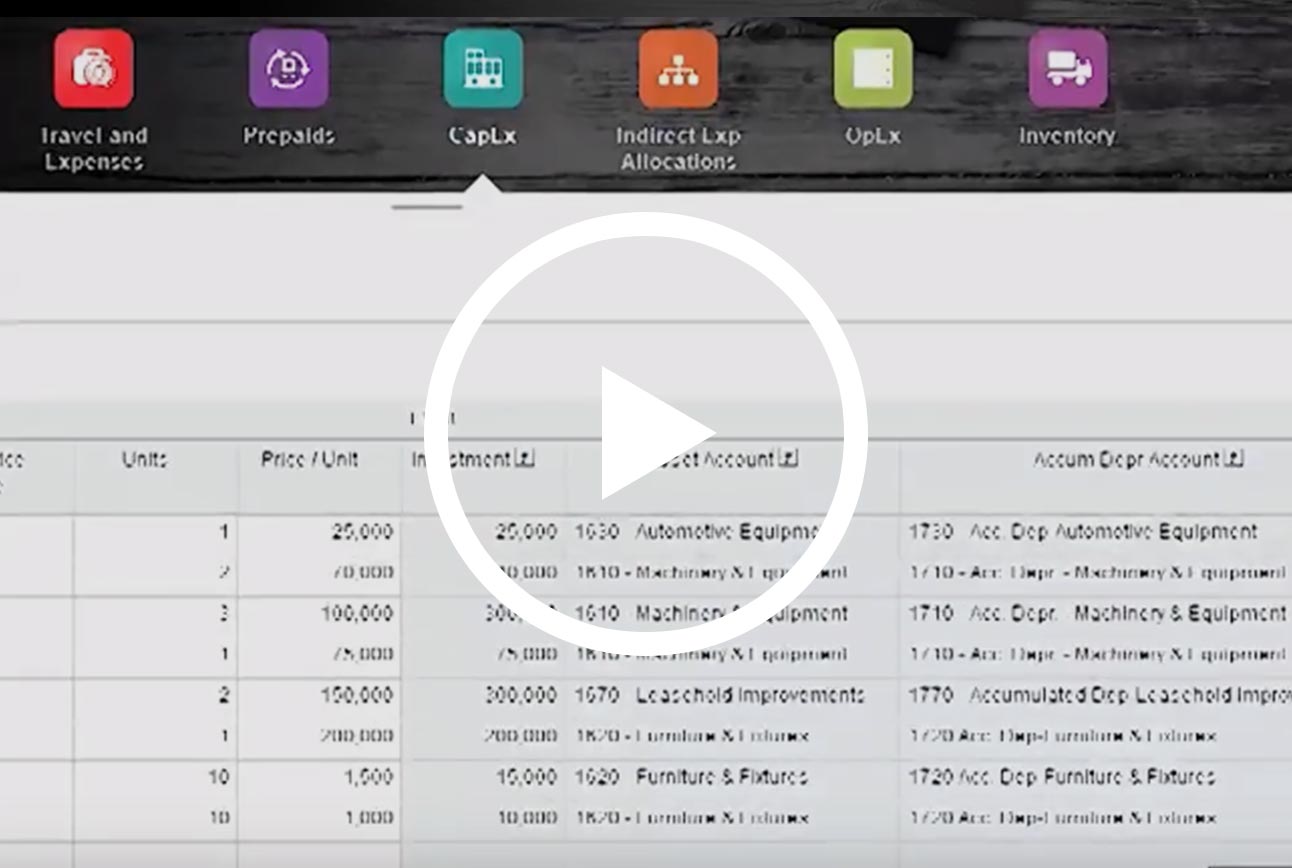

STREAMLINE COMPREHENSIVE CAPEX PLANNING

Oracle NetSuite Planning and Budgeting CapEx planning for SuiteSuccess enables the management, prioritization and planning for capital expenses and its impact on overall expenses and financial statements. You can create a model of your organization’s capital expenses and provide an effective way for decision-makers and managers to communicate throughout the request, justification, review and approval process..

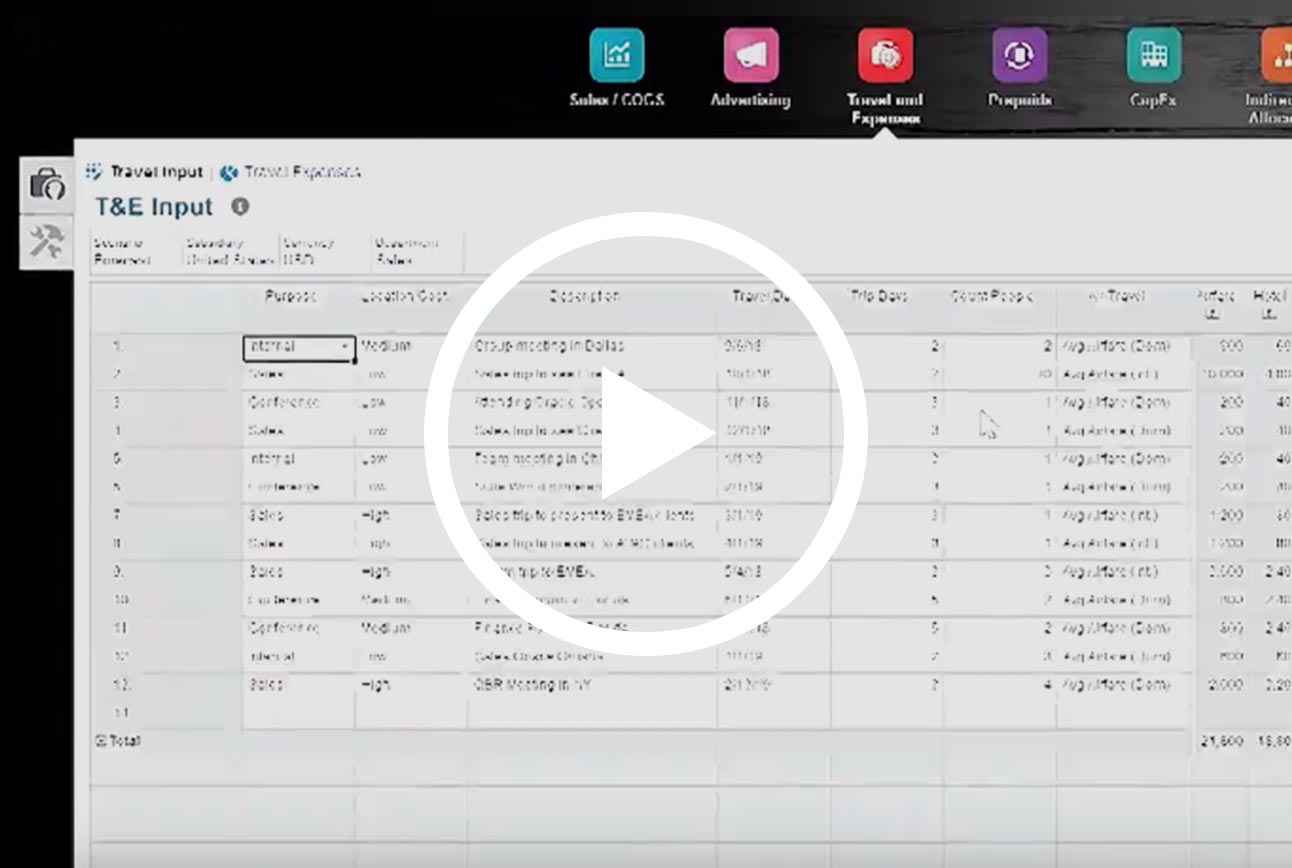

SIMPLIFY TRAVEL AND EXPENSE PLANNING

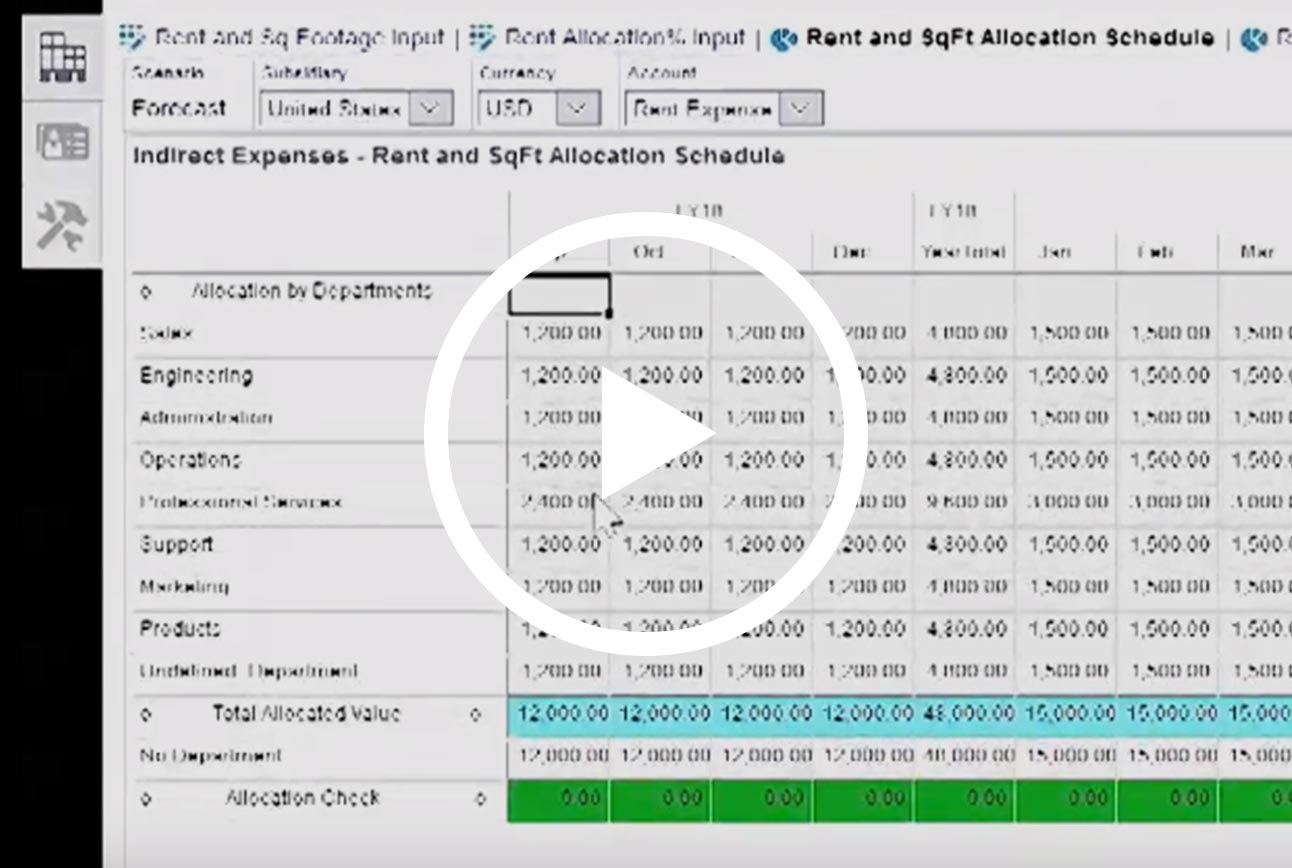

AUTOMATE ALLOCATIONS OF INDIRECT EXPENSES

Oracle NetSuite Planning and Budgeting for SuiteSuccess provides the ability to automate indirect expense allocations giving the you the added insight needed in your planning process, understand true profitability, and help you more effectively map financial and operational data together by provides a central hub for automating all allocation-based business processes.

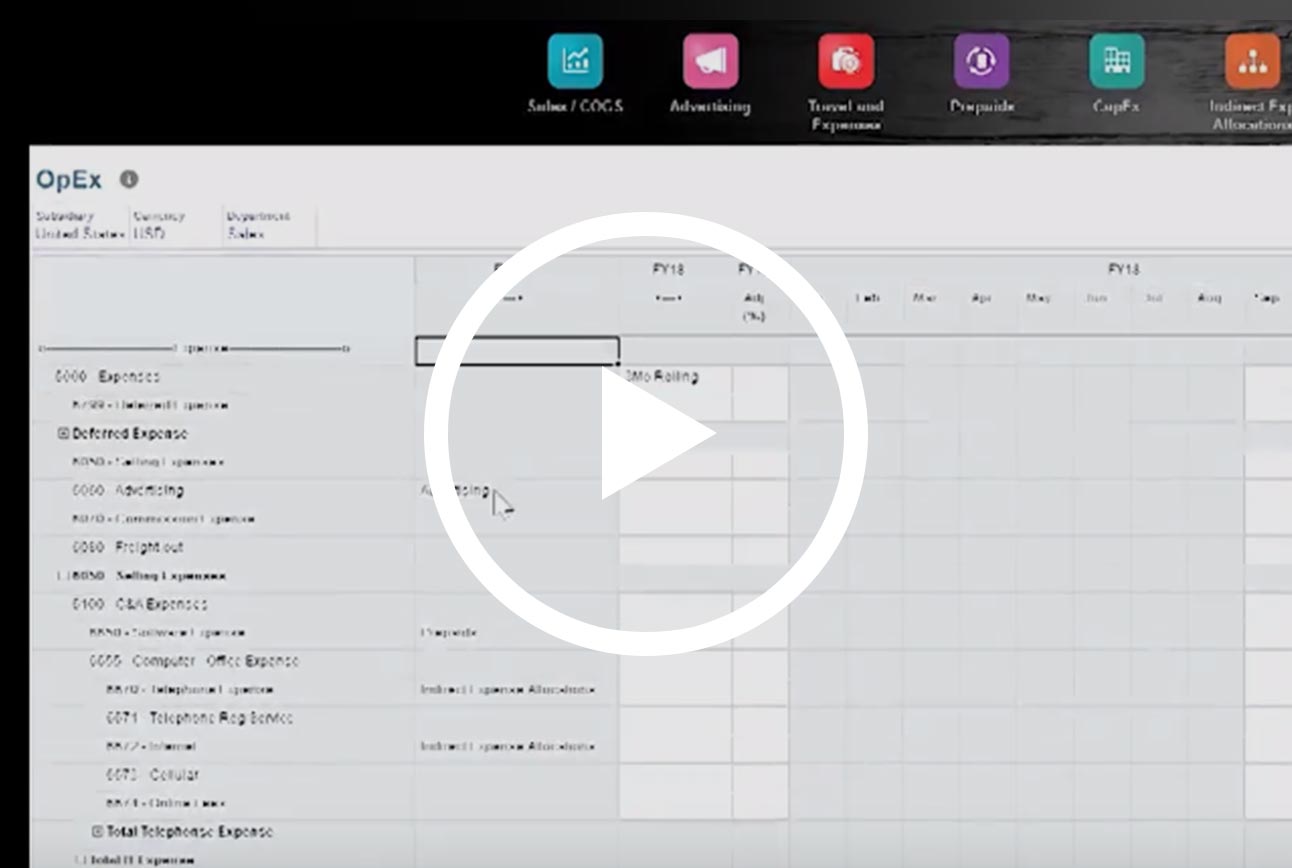

SIMPLIFY COMPLEX OPEX PLANNING

Oracle NetSuite Planning and Budgeting for SuiteSuccess enables flexible driver-based planning to help connect your operational assumptions to financial outcomes and supports a hierarchical planning process that encompasses both corporate finance and lines of business within your organization.

STRATEGIC WORKFORCE PLANNING

Oracle NetSuite Planning and Budgeting for SuiteSuccess simplifies workforce planning and related expenses, such as head count, salary, and compensation planning by aligning the needs and priorities of your organization with those of the workforce to ensure organizational objectives are met.

INTEGRATE FINANCIAL STATEMENT PLANNING

Oracle NetSuite Planning and Budgeting integrated Financial Statement Planning for SuiteSuccess gives you the ability to plan, budget and forecast Revenue, Expense, Balance Sheet and Cash Flow faster, in more detail, with more accuracy and insight.

ENABLE DYNAMIC MODELING, ANALYSIS AND BI-DIRECTIONAL INTEGRATION WITH SMART VIEW

Oracle NetSuite Planning and Budgeting provides comprehensive integration, including single-click refresh, with Microsoft Office tools such as Microsoft Outlook, Excel, Word and PowerPoint with Smart View for Office. You can use Excel as the environment for slicing and dicing data and ad-hoc modelling. Common planning actions, such as spreading and allocation, are available within Microsoft Excel.

IMPROVE FORECAST ACCURACY WITH PREDICTIVE PLANNING

Oracle NetSuite Planning and Budgeting Predictive Planning allows users to optimize planning and forecasting estimates with a rigorous, pre-built statistical modeling engine. With a few clicks, Predictive Planning will collect historical data, match it to industry standard statistical models and generate a dashboard, offering predictions for future results and enabling users to apply predicted values directly into their plan or forecast.

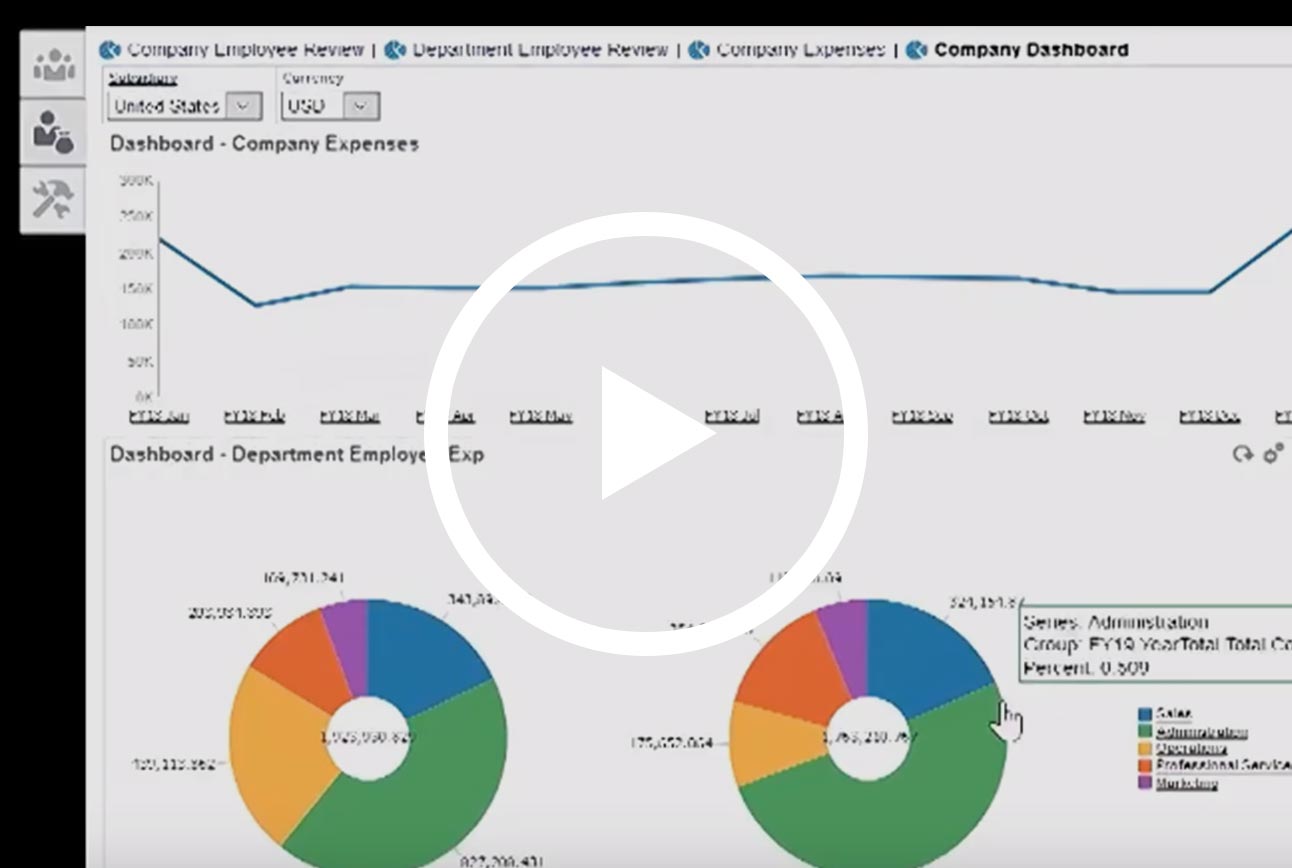

EMPOWER EFFECTIVE DECISION-MAKING WITH POWERFUL REPORTING CAPABILITIES

Oracle NetSuite Planning and Budgeting provides comprehensive reporting and analytics for management, narrative and regulatory reporting. The drag-and-drop report builder puts powerful, yet easy-to-use, web-based reporting into the hands of finance and business managers providing a secure, collaborative, process-driven approach for defining, authoring, reviewing and publishing financial and management reports.

Benefits

Reduce Planning Cycle Times

Collect inputs and assumptions, review iterations and present consolidated results in a timely manner.

Improve Forecast Accuracy

Compare and analyze actual versus projected results regularly to refine forecasts.

Align the Organization

Centralize your budget with forecast and actual information in one place, providing a single version of the truth.

Timely Information and Insight

Drill across budget, forecast and actuals to see the impact on business performance.

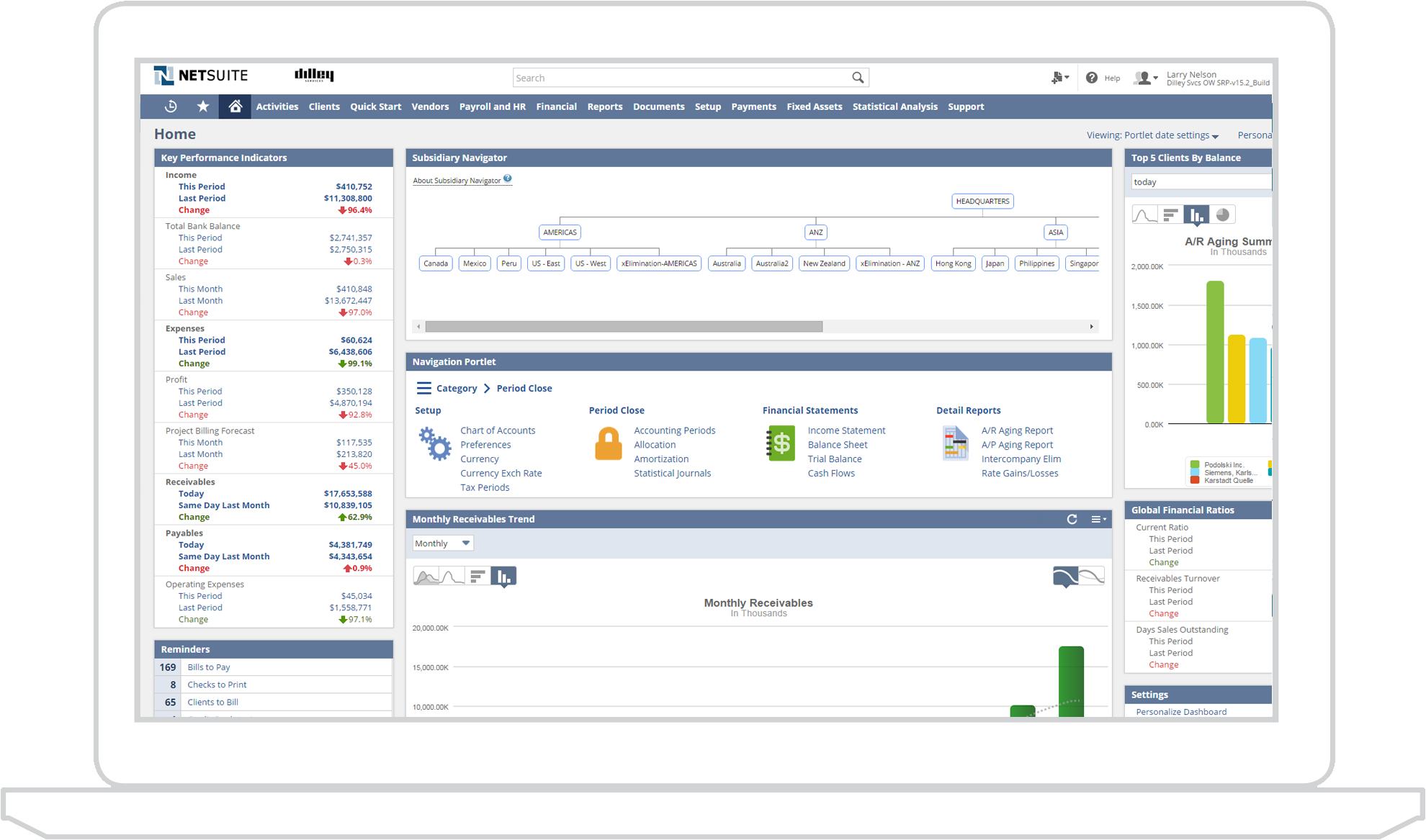

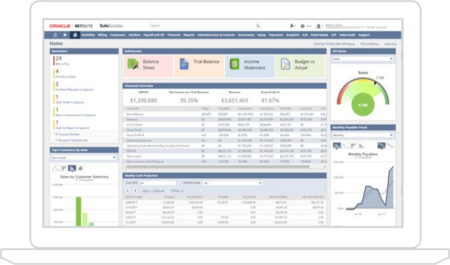

Used by thousands of organizations worldwide, NetSuite’s financial management solution expedites daily financial transactions, accelerates the financial close and ensures compliance. Our cloud-based single platform architecture ensures complete real-time visibility into the financial performance of the business from a consolidated level down to the individual transactions.

Used by thousands of organizations worldwide, NetSuite’s financial management solution expedites daily financial transactions, accelerates the financial close and ensures compliance. Our cloud-based single platform architecture ensures complete real-time visibility into the financial performance of the business from a consolidated level down to the individual transactions.

With NetSuite, your finance team gets more than automated and accurate financial statements. Your entire organization gains a modern financial reporting experience that delivers real-time financial analysis and modeling across every dimension of your business for detailed insights into corporate performance and improved business decision making.

With NetSuite, your finance team gets more than automated and accurate financial statements. Your entire organization gains a modern financial reporting experience that delivers real-time financial analysis and modeling across every dimension of your business for detailed insights into corporate performance and improved business decision making.