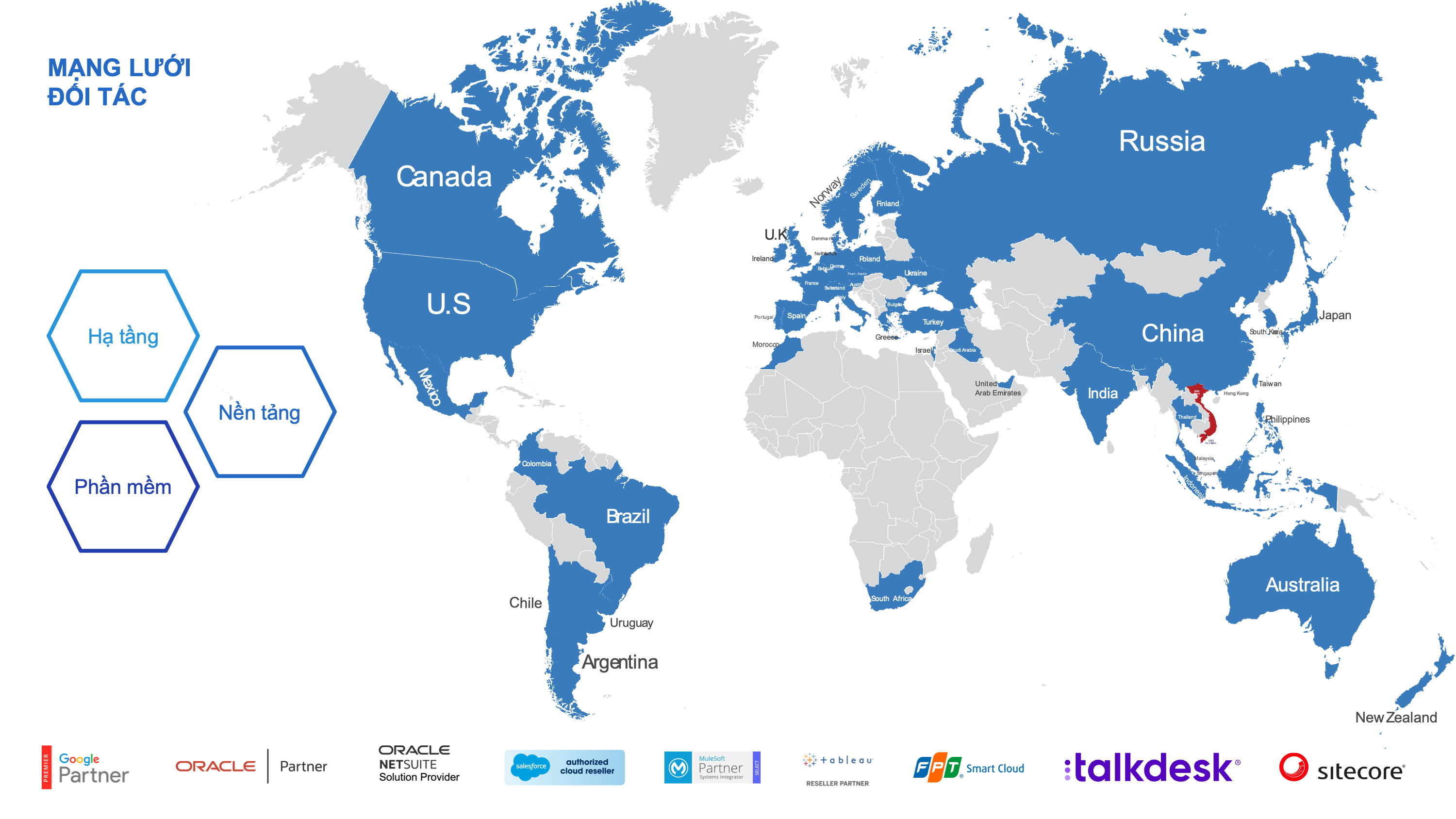

International Capabilities

The World's #1 Global Cloud ERP

International Capabilities

Growing regulatory challenges, compliance risk, financial penalties and more frequent system-based tax audits is leading to businesses being burdened with ever more complex tax compliance requirements. As the world’s #1 global cloud ERP, NetSuite OneWorld’s tax and compliance management capabilities provides a robust foundation for transparency, automation, simplicity and controls in the management of your global tax and compliance responsibilities, enabling you to grow your business globally with confidence.

Used in over 110 countries with support for the most widely used languages, NetSuite’s ‘out-of-the-cloud’ comprehensive indirect tax management and reporting capabilities cover over 90% of Global Gross Domestic Product (GDP) ensuring your business system is ready to handle your international footprint wherever your company operates.

Features

Indirect Tax Compliance

Mismanagement of your tax management processes can result in penalties and interest charges. Whichever way you look at it, the management of indirect taxes is becoming a costly overhead.

Around the globe, indirect tax requirements continue to change frequently and place an increasing burden on businesses, rather than the government, to monitor and report on their compliance responsibilities. Compliance responsibility is a major hidden cost of business operations. A study by PricewaterhouseCoopers found that in many countries on average, it takes a company longer to comply with VAT, than to comply with corporate income tax.

Governments are regularly changing tax rates and laws in an effort to balance their budgets, placing an increasing burden on businesses in the management of the additional tax compliance. Deployed by organizations in over 110 countries, NetSuite can help you address these challenges through:

- Transparency—reduces audit risk with an always-on audit trail, access logs for both external and tax auditors and full drill-down from summary tax forms and reports to underlying transactional data demonstrating the source of calculations.

- Automation—enables standardized workflow across all international operations with tax calculation occurring as part of standard business processes.

- Control—Validation of data entry based on in internal standards and centrally defined configurable approval processes and exception reporting provide confidence in system administration.

- Simplicity—single system architecture means no re-keying of transactional or tax data, avoiding common errors and traceability gaps found in traditional point solutions.

Financial and Accounting Regulations

NetSuite OneWorld is used in more than 110 countries, includes comprehensive indirect tax management and reporting capabilities for some of the most stringent local accounting regulations and gives you the power to go global with confidence. NetSuite OneWorld

- Meets accounting regulations across multiple countries including US, UK, Germany, Japan, Australia, Singapore, Hong Kong, China, Malaysia, Thailand and more.

- Is accredited by multiple bodies including the American Institute of CPAs (AICPA, the Institute of Chartered Accountants in England and Wales (ICAEW) and in Singapore by IRAS as complying with GST and Audit Files.

- Is certified in Germany under IDW AuS 880 and GoBS, Philippines by Philippines Bureau of Internal Revenue, Portugal by DGPC under the Computerized Invoicing software certification (Portugal Decree 363/2010), Japanese J-GAAP compliant and many more.

Configurable Tax Engine

NetSuite OneWorld has a built-in tax engine that is configurable to your specific business needs.

- Out-of-the-Cloud pre-configuration of tax codes and localized reporting for over 50 countries.

- Flexible indirect tax engine automates calculation of Canadian HST, Mexican IVA, German Mwst, Philippines VAT, Australian GST, China Golden Tax VAT and more.

- Cross border sales and Intrastat reporting across all 27 EU countries, including online capabilities for many countries.

Comprehensive Currency Management

NetSuite multi-currency management supports 190+ currencies and exchange rates enabling you to do business with both customers and vendors globally as well as a wide variety of payment options. It provides real-time currency conversion and financial consolidation for all your global operations.

- Out-of-the-Cloud pre-configuration of tax codes and localized reporting for over 50 countries.

- Flexible indirect tax engine automates calculation of Canadian HST, Mexican IVA, German Mwst, Philippines VAT, Australian GST and more.

- Cross border sales and Intrastat reporting across all 27 EU countries, including online capabilities for many countries.

Audit and Compliance Reporting

- Electronic audit is now common practice in many countries for both external auditors and Government tax auditors. NetSuite supports audit files formats for SAF-T (all OECD countries), GDPdU (Germany), IAF for Singapore and many more.

- Always-on audit trail, built-in analytics, access logs and workflow.

- Full drill-down from summary reports to underlying transaction detail provides transparency to aid demonstration of on-going compliance with local statutory and regulatory requirements.

- One system architecture simplifies Sarbanes-Oxley (SOX) and similar compliance obligations by helping ensure standardization and consistent reporting across your business operations.

Payment Processing

NetSuite Electronic Payments enables you to pay your vendor bills and employee expenses across the globe directly from NetSuite, as well as take payments directly from customers.

NetSuite Electronic Payment Processing puts the payments or direct debits into each bank’s predefined file format ready to import into banking software or submit to the bank online, thus lowering payment processing expenses by eliminating checks, postage and envelopes and saving time too.

Comprehensive Language Management

Translated in over 20 languages including Chinese, Japanese, French, German and many more, NetSuite OneWorld enables each employee to select his or her language of choice.